Is there any difference between financial advice and financial planning?

Yes. They are completely different.

Financial advice is about recommending a course of action, usually investing in a financial product such as an ISA, a pension plan or a life assurance policy. There are around 30,000 'Financial Advisors' in the UK authorised to give advice by the Financial Conduct Authority (FCA). Their authorisation ranges from mortgage and protection advice to more complex pensions, investments and specialist fields such as equity release and pension transfers. The FCA keeps a register of each individual and requires them to apply each year for a Statement of Professional Standing (SPS) confirming they have kept their knowledge up to date.

Always check that any adviser you are dealing with has a current SPS and is authorised to give advice in the area you are discussing with them.

Of the 30,000 advisers around 15% are Chartered Financial Planners. These individuals have reached a higher academic standard than their peers by passing challenging exams. A significant percentage of these will also be members of the Institute of Financial Planning (recently merged with the CISI*) and will adhere to the standards set by the Institute which include following the six stages of the financial planning process.

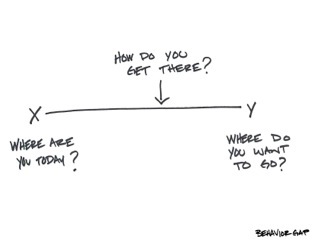

Whilst this is all useful information it doesn't really get to the root of the difference. And that's crucial. I beleive that the difference is not to do with examinations and qualifications, important though these are. It is in fact about the approach to the work of helping people make sense of their finances and also about an entirely different process.

Financial advice is about making financial recommendations. In it's crudest form it is about 'selling' a financial product. Nothing wrong with that provided it's done well and with integrity by a properly authorised individual. Financial planning is not about advice. It is about planning. Step 4 of the six steps (see above) is: “Develop and present financial planning recommendations.” These recommendations may or may not include financial advice.

The real work of financial planning is done in the first three steps. In my view anything to do with finances is intensely personal and we are only willing to discuss personal matters with someone we have come to trust. The first stage of the financial planning process is about the planner really understanding a client's aspirations. This requires empathy, patience and an ability to listen actively. A client needs to feel that they have been heard.

The second and third steps are about gathering financial information and creating an accurate view of the client's current financial status. This in itself can be helpful and traumatic by turns. Nevertheless done properly it is the truth about a person's financial position. The client then has the benefit of the planner's clarity of vision as someone who is outside looking in. I often say to my clients that one of the benefits of working with me is that I am not you. I can see what's happening.

A good financial planner will in time become a trusted advisor. And that is not just about financial advice.

If you would like to spend an hour with Nicholas at his expense to discover how financial planning may be able to help you, drop him a line at nlee@demontfort.biz or call 07725 784348. More information at www.financiallifeplans.co.uk