Money and Happiness

Everyone knows that money can't buy you happiness... right? Obvious! The evidence is overwhelming – lottery winners who end up in a dreadful mess despite their millions, successful businessmen and women with divorces and strained relationships despite their wealth and success... the list goes on.

Everyone knows that money can't buy you happiness... right? Obvious! The evidence is overwhelming – lottery winners who end up in a dreadful mess despite their millions, successful businessmen and women with divorces and strained relationships despite their wealth and success... the list goes on.In my experience the opposite is also true. Lack of money is equally debilitating – too much month at the end of the money, rising credit card debt, a mortgage that never seems to diminish. This leads to a corrosive sense of hopelessness which looks and feels very much like despair. Most of us have had an experience of this at some time in our lives – and none of us want to go back there.

Where is the balance? This is a personal challenge for all of us because there is no 'one size fits all' answer... Here are some thoughts in no particular order.

- First thing is to accept the importance of money in our lives – and not ignore it, avoid it or somehow imagine it will take care of itself. It won't – trust me. Getting a grip on your finances takes time and effort.

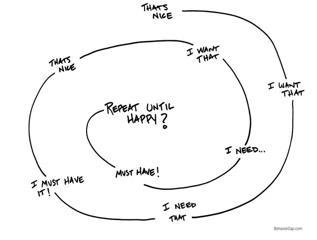

- Second, we need to acknowledge that we live in a consumerist society. There is a whole industry dedicated to creating desire and they know how to do it very well. To imagine that we are somehow immune to their clever, subliminal blandishments is naïve. We all believe that a Rolex watch, a BMW motorcar or a detached house defines our success. Just pick your example – it may not be watches or cars or houses for you…but I bet it's something that somehow enhances your sense of self. It might be qualifications conferring status. Be honest with yourself...

- Third, we need to ask ourselves the right kind of questions. What makes us happy? When do we feel most at ease and relaxed? Answering these questions honestly requires courage – we have all been subjected to conditioning, so don't take your first answer as the best one. Think of a time when you felt happy – where were you, who were you with, what were you doing? These answers will give you valuable clues about to what really matters to you.

- Fourth, start thinking about how you might do some more of that. Ignore the rational excuses for now – haven't got time, need to pay off the mortgage first etc. etc. Allow yourself to dream just enough to begin to sense what freedom might feel like. This is the beginning of thinking for ourselves and creating our world, not one that has been sold to us by advertisers.

Most of us won't do this. It's challenging and time consuming and, in my experience, we need help to get started and maintain momentum. I have two suggestions: Read 'Your Money or your Life' by Vicki Robin & Joe Dominguez (http://goo.gl/m3g9iM) and follow the 9 Steps. This will help you to understand the single most important concept in personal financial planning: our most valuable resource is time, not money. Once we understand and act on that truth the way forward becomes much clearer. And find a financial planner you can trust and work with them. We all need guidance with this, very few of us manage it alone.

If you would like to spend an hour with Nicholas at his expense to discover how financial life planning may be able to help you, drop him a line at nlee@demontfort.biz or call 07725 784348. More information at www.financiallifeplans.co.uk